Investing for Peace of Mind and Long-Term Success

October 14, 2025

Should you try to beat the stock market, or just match it?

I get asked this question all the time, and most financial advisors get it wrong. Read on to find out why – and what it might mean for you, your investments, and the ability to live your life without worrying about stock market returns.

Overview of passive versus active investment management

The above question boils down to a debate between passive investment management versus active investment management.

Passive is basically “set it and forget it.” It’s designed to give you the exact same return as an index, such as the S&P 500 (less a nominal fee).

Active, on the other hand, is where an investment manager is actively researching, buying, and selling stocks within the portfolio. It’s designed to outsmart the market over time.

The thing is, in recent years it hasn’t even been a debate. Passive has trounced active. Want to know how badly?

According to the 2025 SPIVA (S&P Indices Versus Active) Scorecard, for every 100 US investment fund managers tracked over the last 20 years, only around 6 could beat a simple index fund. These are smart people with every advantage, and around 94% of them lost to a fund that requires no thinking.

So why do I believe in active management? Stay with me here…

Why do so many active managers underperform?

Depending on the source, there are several common reasons for this. However, in my opinion, the biggest one is financial incentives.

Investment managers are in the business of attracting and retaining assets. If people invest money in their fund, a manager makes money. If people pull money from their fund, a manager loses money.

And for better or worse, most people have a short-term mindset when it comes to investing. If you ask me why 94% of investment managers underperformed their benchmark over 20 years, my answer would be because 94% of them probably catered to the whims of impatient customers.

In other words, instead of sticking with a clear long-term strategy, they competed for short-term returns. Or worse, they simply stuck as close as possible to their benchmark index, for fear of lagging behind too much.

But great managers stick to a process. Period.

The value of a good active manager

Have you ever heard of Ben Graham? He was legendary. In fact, he even mentored Warren Buffett. And he once said something that still holds today:

__________

“In the short run, the stock market is a voting machine. But in the long run, it is a weighing machine.”

__________

In other words, in the short run, it’s a popularity contest. But in the long run, it weighs what stocks are actually worth. It’s why history is full of examples of short-term bubbles. Periods of time when stock investors got so caught up in the hype of the day that they stopped paying attention to fundamentals.

Picture this: it’s 1999 and investors are rushing to get into any stock with a “dot com” in the company’s name. This new phenomenon called the internet is going to change the world as we know it. And it’s going to make savvy investors incredibly rich!

This is the classic “voting machine” Ben Graham taught us about.

Then came March, 2000. Just as the dot-com party was about to hit maximum capacity, the lights came on and the DJ declared it was time to go home. Prices of high-flying internet stocks came tumbling down to better align with their actual value.

Meanwhile, stock prices for highly profitable “boring” businesses went up. The voting machine became a weighing machine again.

And investors were reminded of one of the most important rules of great investing: fundamentals don’t matter until they’re the only thing that matters.

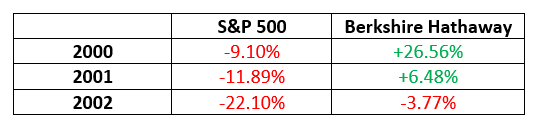

Graham would have been proud of his protégé. Despite lagging the S&P 500 during the height of the bubble, Buffett’s Berkshire Hathaway stock significantly outperformed when the bubble popped:

Now, it’s important to note that Berkshire Hathaway is a single company. And it’s too risky to simply own one individual company’s stock. However, being that Berkshire is in the business of investing in lots of other businesses, I think this illustrates the value of blocking out short-term noise in favor of a disciplined investment process.

It’s times like this – when the market resets and begins a new cycle – that a great active manager truly earns their fee. What matters more to you: beating the market every quarter, or having a strategy that works when the market loses its mind?

The case for active management today

To keep with our theme of learning from legends, let’s explore another timeless quote. This time, from a man by the name of John Templeton.

__________

“Bull markets are born on pessimism, grown on skepticism, mature on optimism, and die on euphoria.”

__________

To understand what he meant, let’s break this down a little further.

Born on pessimism. Historically, every market crash has been a great investment opportunity in hindsight. But in the immediate aftermath of a crash, investors are left scarred by what just happened. And despite the great investment opportunity in front of them, most investors are feeling too pessimistic to get back in the market.

Grown on skepticism. Once a new market recovery shows enough resilience, more investors begin dipping their toes back in the water. However, they still feel quite cautious because the crash is still pretty fresh in their memory. A new bull market gets underway, and most investors are skeptical that it can continue.

Mature on optimism. At this point, most investors fully acknowledge that the market is back on track. In this stage of the cycle, it’s like investors start seeing an “all-clear” signal. Skepticism, particularly in the media, turns into optimism.

Die on euphoria. This is the “FOMO” stage, where investor sentiment has completed a 180-degree turnaround. Gone are the days of people fearing the market. Now they fear missing out, which is typically fueled by an exciting story.

Clearly the dot com bubble was driven by pure euphoria, with the narrative centering on this new thing called the internet. Are we in a similar situation today, with all the hype surrounding Artificial Intelligence (AI)?

Jeff Bezos, founder of Amazon, is no stranger to bubbles. He ran one of the few businesses that survived the dot com crash. Not only did Amazon survive, it thrived, becoming the fifth largest company in the United States today.

Here’s what he recently said about AI speculation in the market:

__________

"When people get very excited...every experiment gets funded, every company gets funded...And investors have a hard time in the middle of this excitement distinguishing between the good ideas and bad ideas"

__________

I’d argue that we’re close to the euphoria stage right now, although it’s impossible to know when the stock market will go through its next major correction. The AI boom could last several more years, or it could end tomorrow.

This is why trying to “time the market” by getting out now is a terrible idea. The late stages of a bull market often provide some of the best returns. Missing out on them can be devastating for investors who need long-term growth.

A much better solution is to find a good long-term investment manager who focuses on the fundamentals. If the bubble continues inflating, you may lag a bit. But you’ll still have assets invested and grow your net worth.

And you can rest easily, knowing that you’re well-positioned to capitalize after the party ends and the markets reset.

Keys to finding the right active manager

The right active manager can be incredibly valuable. But only if they have three things:

An institutional pedigree. Large institutions don’t chase short-term returns. They invest to meet the objectives of their organizations over long periods of time. As we established above, this mindset is critical for a good active manager.

Decades of experience. There’s a big difference between theory and reality. It’s important for a manager to have real-world experience navigating several market cycles, which can only be achieved through decades of work.

Long-Term success. If the point of hiring an active manager is to beat the market, it’s important to hire one who’s actually done so over a long period of time.

This is why Reflective Wealth recently partnered with Sowell Affinity, a team that has more than two decades of experience managing assets for large public and private institutions. They prioritize attractively valued businesses whose underlying fundamentals are improving. And this is paired with a systematic stock selection process, designed to remove short-term emotions.

Historically, the only way to access this type of investment manager was by paying them a percentage of your portfolio value. Which means that as the value of your portfolio increases, so do your fees.

For those Reflective Wealth clients with at least $1 million to invest, this is part of an all-inclusive monthly subscription that includes comprehensive financial planning. What that means is that there’s no rising scale, regardless of how much your portfolio value increases.

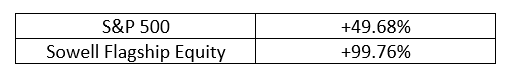

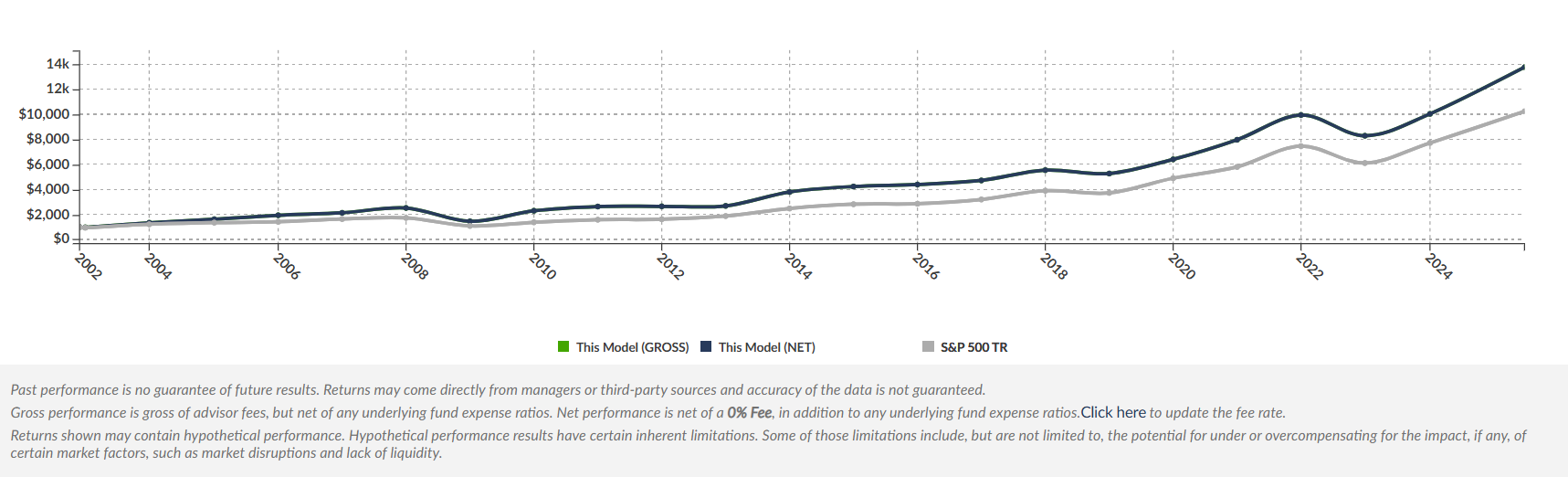

The core of our portfolio is called the Sowell Flagship Equity Strategy. Of course, there have been periods where it lagged its benchmark (the S&P 500), but it’s delivered significant outperformance during the types of market resets we’ve been talking about.

Let’s look at a couple of examples:

“Dot Com” Reset: 2003 - 2005

“Great Financial Crisis” Reset: 2009 – 2011

And because this strategy is run by a team that prioritizes fundamentals over hype (and long-term returns over short-term gains), it’s delivered strong results for patient, long-term investors. The average annual return since inception (12/01/2002) has been +12.31% versus +10.85% for the S&P 500. And the cumulative return since inception has been +1,280% versus +920% for the same index.

The importance of planning

To be clear, the “resets” described above are the early stages of a new bull market, after the damage of a bear market has already been done. Which is why we pair our clients’ stock portfolios with an allocation to cash-like instruments. This portion is meant to hold its value during significant stock market declines, while earning interest in the meantime.

Depending on a client’s cash flow needs, we determine an appropriate amount that will cover their portfolio withdrawals for a defined length of time. This helps us to avoid realizing big losses by selling stocks during an inevitable bear market – something that can destroy wealth over time. And it allows us time to ride out the storm, enjoy the recovery, and ultimately get the most out of our long-term investment strategy.

At the end of the day, I believe investing should give you peace of mind to live your life without worrying about the inevitable ups and downs of the stock market. It’s a way to achieve and maintain financial freedom.

When you know your investments are in good hands and you’ve got a sound financial plan in place that promotes and protects your ability to achieve your most important goals, achieving the life you want gets a lot less complicated.