Maximize Your Freedom With A Personal Pension Fund

December 19, 2025

What would it take for you to walk away from a paycheck without anxiety?

I keep coming back to this question because it's really at the heart of what I mean when I talk about Affordable Freedom. I'm not talking about retiring early or having so much money you stop caring. I'm talking about knowing you'll be okay.

Back in the day, this feeling was much more common. People called it a pension.

The script was simple. Get a good job. Work there for 35 years. Retire with a steady income for life. You could stop working and know, with full confidence, that your needs would be met. Most people weren't trying to maintain an extravagant lifestyle. They just wanted to know they'd have enough.

But then people started living longer, pensions became a financial drain on companies, and they went the way of the dinosaur.

Most people will never know what it's like to have a real pension. But you can actually create your own*. And you don't necessarily have to wait until traditional retirement age to start collecting this income.

How does a pension fund actually work?

While there are complexities behind the scenes, the basic mechanics are pretty simple. Money goes into a fund. The fund gets invested in different assets. As people retire, money gets paid out in a steady stream over time.

The key is sustainability. The payouts can't drain the fund. The fund has to keep growing above and beyond what's being withdrawn.

Many people assume these large institutions have some "secret sauce" giving them superior returns. They don't. While they do have access to private / alternative investments, those are mostly for diversification purposes.

When stocks zig, they want something that zags. This provides stability when you're managing payouts to thousands of people.

But for an individual who only has to worry about paying money to themselves? And who has flexibility to adjust their withdrawal if needed? Those exclusive tools aren't necessary.

How much would I need to create my own personal pension fund?

If you're thinking it's probably a lot, you're right. But maybe not as much as you assume.

The exact amount depends entirely on what "enough" looks like for you.

Just like a real pension fund, the income you withdraw must be sustainable, allowing your overall portfolio to keep growing. While the percentage can vary based on how you're invested, I tend to limit withdrawals to around 5% annually.

Based on this, here's what you could safely withdraw at different portfolio sizes:

$500,000 = $25,000 income

$1,000,000 = $50,000 income

$2,000,000 = $100,000 income

But here's what makes this interesting: the income grows over time as your portfolio grows. If you have a $1M portfolio that goes up 10% ($100,000) and you withdraw 5% ($50,000), you still have $50,000 more than you started with.

Now you have $1,050,000. And your 5% withdrawal suddenly becomes $52,500 instead of $50,000. You probably don't need that extra $2,500 right away, so you leave it to keep compounding.

Repeat this over time, and you can build a steadily rising income stream.

"But Bryan, all my money is locked up until 59½."

I hear this a lot. And I understand why. It's what we've been told.

But here's the truth: the money isn't actually locked up. You just have to pay a price to access it early.

Is this ideal? No. Should you avoid it if you can? Yes.

But sometimes traditional financial advice keeps people from living happier, more fulfilling lives. And sometimes paying that price is worth it.

Let me show you what I mean.

I want you to imagine someone like John. (FYI: John's not a real person.) He's 45, earns $250k, spends about $10k a month, has $1M in retirement savings and a home worth $700k. By most measures, John's doing great.

But John works 50 to 60 hours a week. He's stressed and tired and is rarely home for dinner. He dreams about quitting but can't imagine how he'd make it work.

With some planning, John could take a 50% pay cut, downshift to a less demanding job, and keep his lifestyle intact.

Here's how it breaks down: New income of $125k. Early IRA / 401(k) withdrawal of approximately $36k (just 3.6% of his savings). After taxes and penalties of approximately $41k, his expenses of $120k are covered.

A small annual withdrawal covers the gap while his retirement portfolio keeps compounding. His home value keeps compounding too. In fact, his projections show around $1M of additional savings if he sells at retirement.

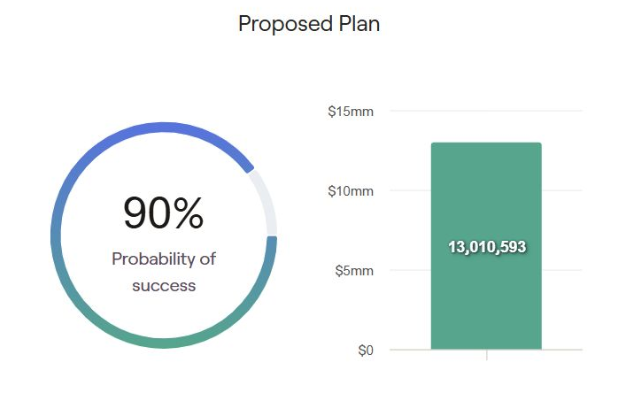

Assuming he retires at 65, with 80% stocks and 20% cash (we'll get to the "why" behind this allocation in a bit), his financial plan shows a 90% probability of success and a median value of $13 million at age 90. And depending on many variables, retiring sooner certainly isn’t out of the question.

_________________________

These projections come from Right Capital, the professional financial planning software I use with clients. If you'd like to see the full analysis behind these numbers, just reply and I'll send it your way.

Would he pay more to the IRS? Sure. Would he give up some upside? Of course.

But maybe that's the price of peace. Maybe it's better to pay a fee for freedom than to keep paying with your time, your health, and your happiness.

"Okay, but I don't have $1 million. That's a lot of money."

I get it. For many people, this can feel like an insurmountable goal. But it's usually not because building wealth is too hard. It's because most people don't know how to do it, and they don't realize how straightforward it can actually be.

Consider a typical married couple with two kids earning a combined $200,000. And to keep it simple, let's assume they only use the standard deduction. And let's assume they claim the child tax credit on both kids. Based on 2026 IRS guidelines, they would owe $21,940 in federal income tax and $14,339 in FICA tax, for a total tax bill of $36,279. Obviously, they might owe additional state income tax. But let's assume they live in my home state of Texas.

After taxes, their take-home pay would be $163,721. If their expenses run $10,000 per month ($120,000), that leaves $43,721 of extra cash flow throughout the year.

If they invested $3,000 per month ($36,000 annually) into a S&P 500 index fund, they'd still have around $7,721 of wiggle room.

Obviously, we can't predict exactly how their investment will grow. But if they had started this approach in November 2013 and continued through November 2025, their investment would have grown to around $1.1 million (less nominal fees for the index fund).

You can run these numbers yourself here

That's 12 years of consistent saving turning into a million dollars.

This is a simplified illustration, during a great run for stocks. But my point is that when we're intentional with where our money goes, building significant wealth isn't as complicated as the financial industry makes it seem.

So, what does this actually look like in practice?

To make this work, you need to understand what "enough" looks like for you. We then need to determine a sustainable withdrawal rate, manage your portfolio allocation to handle market volatility, and create a sufficient cash buffer.

This is where most "personal pension" strategies fall apart, so I want to show you how we can protect against it.

Let’s go back to John in our previous example. Recall that he has a $1M portfolio and needs to withdraw $36,000 per year. Also recall that his hypothetical asset allocation is 80% stocks and 20% cash / cash-equivalents.

Why the 80/20 split?

Because 20% of $1M is $200k. And based on an annual withdrawal rate of $36k, this allows for about 5.5 years' worth of withdrawals to be set aside safely in high-yield savings accounts, money market funds, and other cash-like instruments.

This is important because John's strategy is to sell off a portion of his portfolio each year so he can withdraw cash. And you never want to be forced to sell stocks after they’ve fallen significantly. Doing so can be devastating for your long-term returns.

In fact, this is one of the biggest reasons people using this strategy end up running out of money down the road. In finance jargon, this is what’s known as "sequence of returns risk."

Historically, the stock market pulls back (drops 5-10%) about three times a year, corrects (drops 10-20%) about every 12-18 months, and enters a bear market (drops 20%+) about every 4-7 years.

Generally, a stock portfolio can survive selling and withdrawing during pullbacks and corrections. It's the bear markets that can be a portfolio killer, so this is what we want to protect against.

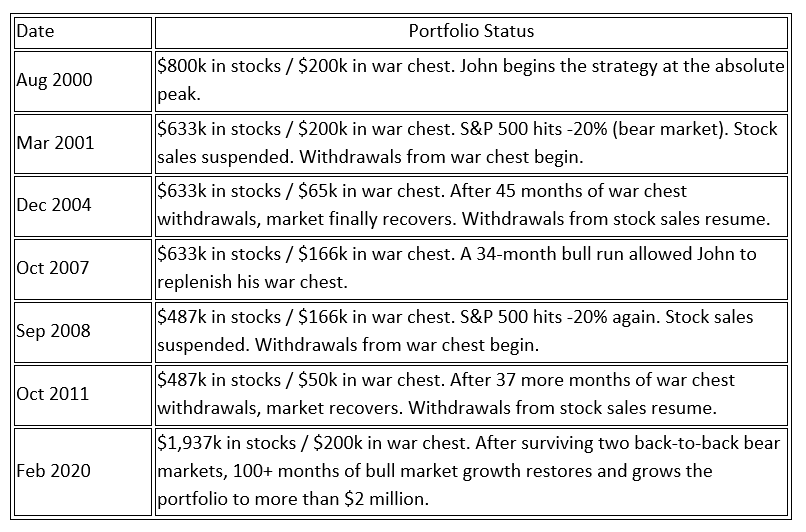

The rule is simple: Whenever the stock market falls into bear market territory (falls by 20%), John will temporarily suspend all stock sales. Instead, he’ll make withdrawals from his cash allocation (let’s call it his “war chest”). And this will continue until the stock market is back above this -20% watermark.

Let's test this strategy in a "worst-case" scenario...

Theory is one thing. Real market history is another. So let's see how John's war chest strategy would have performed during the most brutal stretch for stocks since the Great Depression.

The booming 1990s culminated in the infamous dot-com bubble. The peak was hit around August of 2000. Let's assume John was just beginning this strategy then.

This is arguably the worst possible time in history to start. Being this unlucky is nearly impossible, from a statistical standpoint.

But here's what happened:

The bottom line: John survived the two worst bear markets since the Great Depression, maintained his withdrawals throughout, and came out the other side with more than double his starting portfolio.

Truth be told, he would have likely fared a little better than this illustration, because these numbers don't include dividends. Since many of the underlying companies in his portfolio pay them, that would have been a lot of extra money being reinvested and growing. And it also doesn't include any interest earned on his cash.

Furthermore, if he was a savvier investor, he wouldn't have simply owned a S&P 500 index fund. Had he owned a properly diversified portfolio with international stocks, while taking advantage of opportunities created during two major market resets, he would have experienced a smoother ride. This is why my clients' money is managed by a seasoned team that does exactly this.

_________________________

A note on methodology: All figures above are approximations for illustrative purposes only. The data was compiled using historical returns for the S&P 500 and straight-line calculations. Since this is not how the stock market actually works, these numbers should not be relied upon to make investment decisions. It's important to make adjustments to the strategy, based on real world events. Please consult with a professional before implementing this on your own.

_________________________

While this all looks good on paper, going through it would have been gut-wrenching. I've counseled a lot of families through steep market declines, and it’s never easy. But if it were easy, everyone would do it.

As you can see, though, with good planning and the guidance of a trusted professional, you can navigate your portfolio through inevitable ups and downs, which typically leads to better long-term results, thanks to compounding growth over time.

What does “enough” look like for you?

So, back to the question I started with: What would it take for you to walk away from a paycheck without anxiety?

If you have at least $1 million in investable assets, maybe less than you thought. Does this change how you think about how long (or whether) you need to keep grinding?

And if you don't have $1 million yet, do you think it's attainable? What would need to change?

* Please not that an actual pension fund is a defined benefit plan, which is a specific type of account. While individual investors can set these up, this is not what is discussed in this newsletter. The information in this newsletter is simply explaining how an investor can simulate this type of plan with existing accounts.

Advisory Services through Altruist Financial offered through Reflective Wealth Planning ("RWP"), a registered investment adviser. Advisory Services through Fidelity offered through Sowell Management ("Sowell"), a registered investment adviser. This material is for informational purposes and/or illustrative use only. The material presented does not constitute investment advice and is not intended as an endorsement of any specific investment. As is such, this email is not client-specific, we make adjustments in individual portfolios based on each client's financial plan, income needs, risk tolerance and total asset allocation. The views expressed represent the opinion of RWP and are subject to change. Stated information is derived from proprietary and nonproprietary sources that have not been independently verified for accuracy or completeness. While RWP believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. No warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability, or usefulness of any information herein. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and RWP view as of the time of these statements. Please check source material for more details. The information discussed is not intended to render tax or legal advice. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Consult your financial professional before making any investment decision. Investing involves risk including the potential loss of principal, and unless otherwise stated, are not guaranteed. Past performance does not guarantee future results. No investment strategy can guarantee a profit or protect against loss in periods of declining values.